- Home

- Bank Loans

- _UBA

- _Zenith

- _FBN

- _Union

- _FCMB

- _GTbank

- Loans Information

- _Credit Score

- _24hrs Loans in Nigeria

- _Loan apps in Nigeria

- _Emergency loan in Nigeria

- Loans Review

- _9ja Cash

- _Zedvance

- _Palmcredit

- _Lydia

- _Branch

- _Carbon

- _Rosabon Finance

- _Renmoney

- _Migo

- _Quickcheck

- _Specta

- _Fairmoney

- _Fint

- _Sokoloan

- _Kiakia

9ja cash Loan App: 2020 Reviews & How to Apply

With 9ja cash-quick loan app, you can apply for a loan without collateral. Up to N300…

Zedvance Loan: 2020 Reviews & How to Apply for up to N5million

Need a loan? Get one with Zedvance loan. Here's how to apply without collateral a…

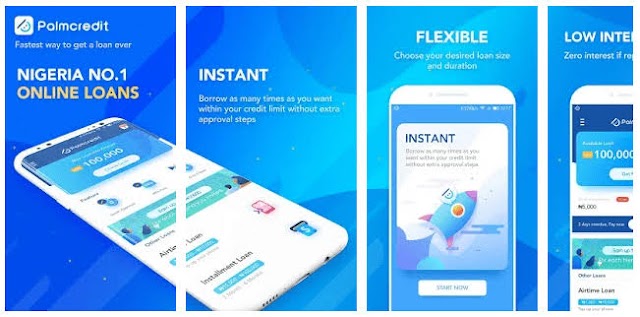

PalmCredit Loan: 2020 Reviews and how to Apply without Collateral

With palmcredit loan app, you can apply for a loan up to N100,000 no documentation or…

Payday Loans for Non-US Citizens

If Nigeria citizens want to move in the USA, they are welcome to borrow payday loans only if they are legal permanent residents.

Glo Cash Loan

Glo Nigeria offers Glo quick cash mobile money loan to all Glo customers, who can also make money as a Glo affiliate in Nigeria.

Menu Footer Widget

Copyright ©

Loans Nigeria